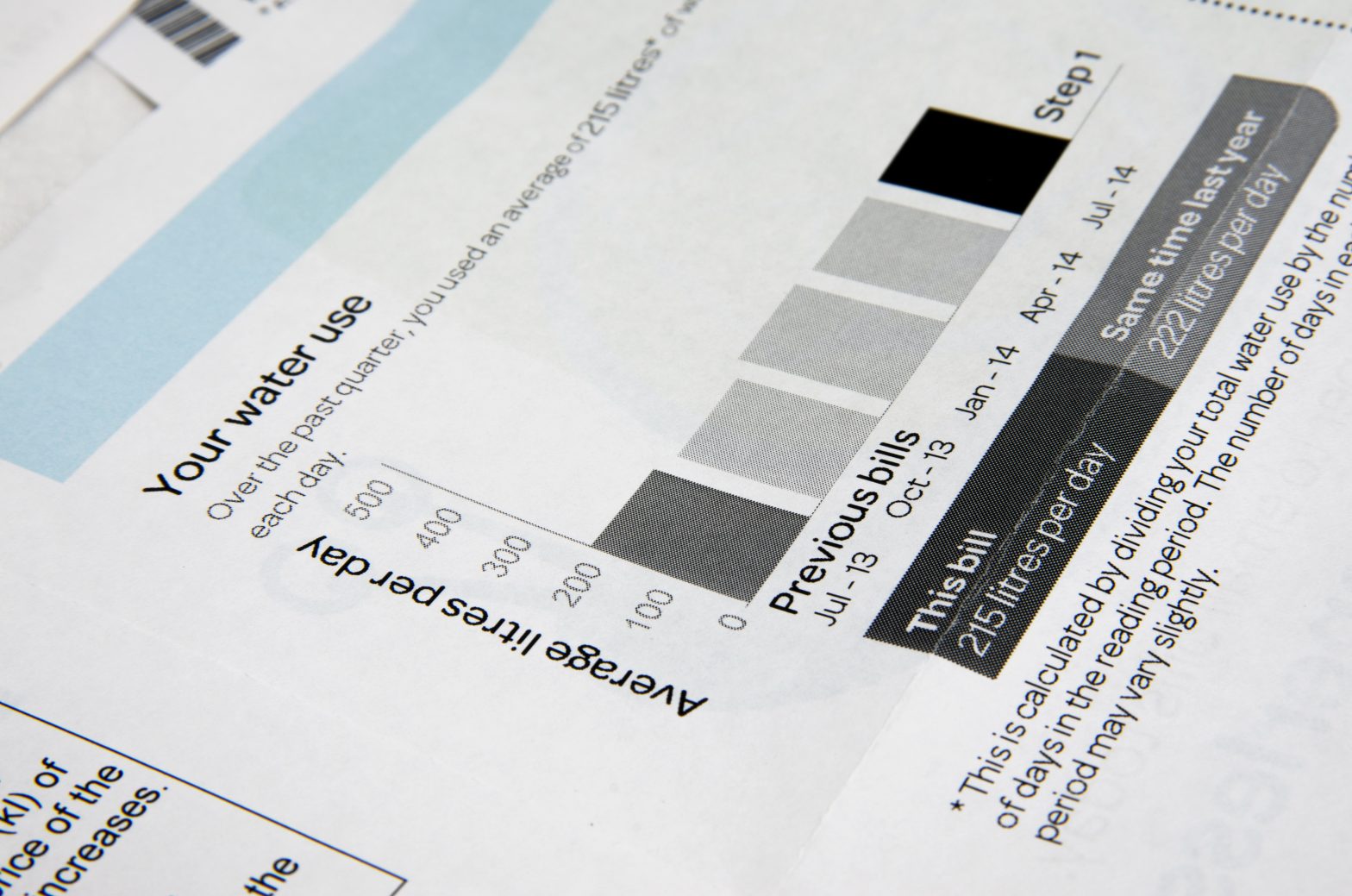

Although water bills are not usually very high so are probably not on the top of your list to cutting down, it can be worthwhile taking some careful actions to keep your bill and usage down.

Here are some simple ways to save money on your water bill:

- Dishes: Don’t wash dishes with running water. Fill up a bowl or one side of the sink with water and dishwashing liquid and use when washing the dishes. If you have a dishwasher, load it up and only turn it on when it is completely full.

- Laundry: Like dishes, wait until you have full loads of washing to do. This does not only save you money, it saves you time by doing the washing less times a week. You may also want to look into a front-loader washing machine. These are generally more water efficient than top-loaders.

- Showers: It is recommended to have shorter showers to save money, and we agree. However during winter, we know how hard this is! Look into a low-flow shower head instead. This can reduce the amount of water you use while showering by as much as 50%!

- Pools: If you have a pool, get a cover for it during the cooler months that you are not using it. This saves you from refilling the water levels as well as keep the water clean. You may even want to talk to a pool professional to discuss sort of filters and pumps that you can use to save you water as well.

- Taps and Mixers: If you haven’t changed your taps and mixers for a long time, it’s probably time to. There are many new taps and mixers on the market that are great at saving water.

You will be surprised how these simple, yet efficient ways can save you money on your water bill!

For information about other options for managing bills and debts, ring 1800 007 007 from anywhere in Australia to talk to a free and Independent financial counsellor. Talk to your electricity, gas, phone or water provider to see if you can work out a payment planIf you are on government benefits, ask if you can receive an advance from Centrelink: www.humanservices.gov.au/advancepayments.

The Government’s MoneySmart website shows you how small amount loans work and suggests other options that may help you.

* This statement is an Australian Government’s requirement under the National Consumer Credit Protection Act 2009.